Five Friday Facts #62

Top 10 luxury brands on Sina Weibo

Automobile brands continue to top the luxury sector when it comes to presence on social media in China. The chart below shows the growth of top 10 luxury brands on Sina Weibo between August’11 and November’12. Within the 15 month period, there was a reported growth of 490% in fan base. Cadillac and BMW top the charts with 850,613 and 598,322 followers respectively. Cadillac also has three verified Sina Weibo pages for their distributors. The other luxury brands in the chart are fashion brands, with Chanel showing an impressive 984% growth in fan base. Even though, Dior and Coach are new to the scene, they have close to 500,000 fans each. It is noteworthy that some of these brands are doing better on social in China than they are on Facebook or Twitter in any other given country.

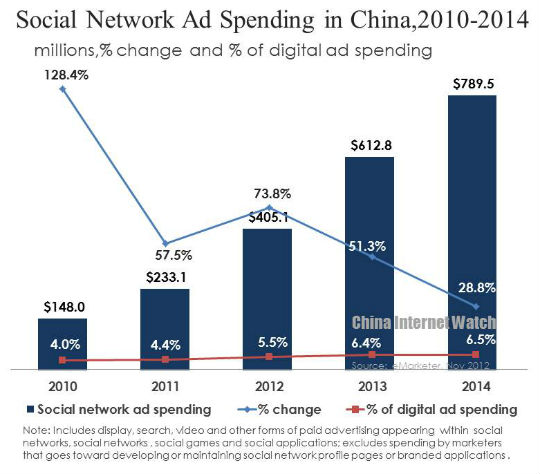

Social media ad spending in China

The number of social media users in China is estimated to be more than 597,000,000 as depicted in our latest #SDMW report. With the largest number of social media users in the word, social network ad spending is expected to reach $612.8 million this year. As more brands start to get onto the social media bandwagon, homegrown networks such as Sina Weibo, Renren and Tencent will continue to reap the benefits of what the marketers sow in advertising spend.

China, Singapore and Brazil lead consumption of digital media

According to the KPMG International 2013 Digital Debate, urban consumers in China, Singapore and Brazil are the world’s most voracious users of digital and social media. This is definitely led by the high usage of smartphones and tablets. The second screen experience is on the rise in these places with consumers staying connected to multiple devices whilst watching TV. In China, 48% say they use their smartphone and 60% use their laptops while watching TV. with 36% of these people accessing social networks. Brazil and Singapore fall into the same category as China in this phenomenon.

The very social Thailand

Global Web Index (GWI) introduced its Social Engagement Benchmark (SEB) score not long ago. A recent analysis by GWI shows great insights into the Thai market. Unlike other countries in the world, the gap between active and passive social media users is narrow in Thailand. The active Facebook population in Thailand is an impressive 74% whilst Italy’s, one of the highest in Europe is at 47%. GWI estimates a total of 15 million Facebook accounts in Thailand, out of which 12 Million are active users. An interesting thing to note here is that markets like Thailand in Asia are in parity with matured markets like Australia. Despite their lower internet penetration, they have faster growth and a much more engaged customer segment. And not to forget Thailand’s mobile scene – With a 117% mobile penetration and fast growing internet connectivity, Thailand is positioned well above the Asian average.

Social TV takes off after broadcast

After watching their favourite show on TV, viewers get onto social media to participate in or start a coversation with their mates. A Nielsen survey conducted in September of last year, showed that 29% of Americans updated their Facebook status whilst watching the program. What is interesting to note is that more people are getting influenced by social media to catch a particular program. 46% said Facebook was their influence to start watching a program whilst 14% cited Twitter. Social TV is definitely taking off with more and more ongoing conversations on the shows’ respective Facebook pages even after the program has broadcasted.