Social Networks Are Diversifying

The wonderful folks at GlobalWebIndex have been great partners to us over the years, most recently helping us to put together our report on digital stats from around the world. In this guest post, GWI’s Jason Mander shares his take on the rapidly evolving world of social media, and what it means for marketers.

Look through We Are Social’s comprehensive new Digital, Social and Mobile Worldwide in 2015 report, and it’s clear why fast-growth markets are now so important to digital and social trends: regions such as APAC and LatAm contain online populations which are not only vast in size but which are growing at phenomenal year-on-year rates.

What’s more, GlobalWebIndex’s data shows that digital consumers in these fast-growth/emerging markets are some of the most engaged when it comes to online behaviour. We’ve been tracking the daily time that people spend on various forms of media since 2012; by asking our 170,000 annual respondents how long they typically devote to the internet as well as online and offline forms of TV, press and radio, we can build a detailed profile of daily media behaviors. The results show that the internet is capturing more and more of our time each day – with total hours spent online via PCs, laptops, mobiles and tablets growing from 5.55 in 2012 to 6.15 in 2014.

One of the drivers of this is still-increasing levels of engagement with social networks, which have climbed from a daily average of 1.61 to 1.72 hours over the period in question. This offers important food-for-thought given that some commentators still like to proclaim the “end of social networking”. In actual fact, we’re spending more time on networks now than in the earlier part of the decade – with the rise of the mobile internet, and the ability it affords us to connect to a still-widening range of networks at any time and from any location, being a major driver of this.

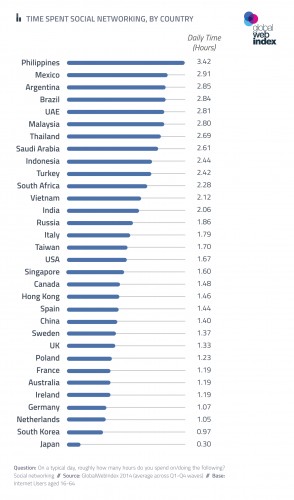

Click image to enlarge: Average number of hours per day spent using social networks, by country. NB: GlobalWebIndex have calculated these average times using data for all internet users (including those who do not use social media at all), whereas the figures in We Are Social’s Digital, Social, & Mobile 2015 report are averages based on the same source data, but which do not include the data for non-social media users.

That said, engagement with social networking can vary significantly from country-to-country. Typically, it is highest in fast-growth/emerging nations where online populations are skewed towards young, urban and affluent demographics (all of these being characteristics which increase an individual’s likelihood of being a social networker).

The Philippines posts the highest figure of all (with a sizeable 3.42 hours), but LatAm countries follow very closely behind. It’s hardly a surprise that there’s a very strong correlation with usage of the mobile internet here; where the mobile web scores well, we typically see social networking accounting for large amounts of daily media time too.

At the other end of the spectrum, we find the lowest amounts of time being devoted to networks in a number of mature markets; here, internet penetration rates are normally very high, meaning the corresponding online populations have a much broader / higher age profile, and are more representative of the country’s total population.

In short, older segments are better represented in mature nations but are some of the least enthusiastic about social networking – something which has an obvious impact on national averages. Japan appears at the very bottom of the table, with just 0.30 hours spent on networking per day; the lack of enthusiasm for networks generally – and for Facebook in particular – are key local factors in this market. Behind this are other mature APAC markets such as Australia as well as most of the European countries tracked by GWI.

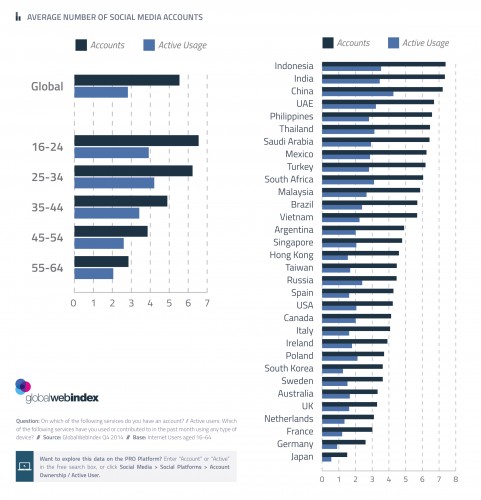

Given these geographic and demographic patterns, it’s hardly a surprise that internet users in fast-growth nations are also the biggest “multi-networkers” (those who maintain accounts on the highest number of social platforms). Indonesia tops the table here, with internet users typically being members of 7.39 networks, but it’s in China where people are most likely to actively use the greatest number of social networks (4.27 per internet user). That there are so many local platforms in China is a major contributor to this, as is the fact that leading global names such as Facebook are not as off-limits as is often assumed.

In some studies – especially those based on data from passively collected analytics – it’s still common to see Chinese usage of Facebook, Twitter and similar sites recorded as zero. This is a major mistake; there are in fact a number of ways that Chinese internet users are bypassing official restrictions on social networks, including accessing via apps (16% in China say that they have used the Facebook app in the last 30 days, and a look at the top apps being downloaded in China on a daily basis shows that Western social networks feature very prominently within the list).

Click image to enlarge: Average number of active social media accounts maintained by internet users, broken down by age and by country.

Significantly, VPN (Virtual Private Network) apps are also being widely downloaded in China – with these tools representing the other major access route for those Chinese users looking to bypass official restrictions. Close to a fifth of online adults in China in fact say they’ve used a VPN in order to access restricted websites or social platforms.

Not only does this trend underline the potential limitations of using passively collected, geo-located data in isolation – which can over-estimate the size of social audiences in markets such as the USA, Netherlands, South Korea and Sweden, where VPN and Proxy servers tend to be located – it also emphasizes the growing futility of attempting to prevent national audiences from accessing certain sites. Most clearly of all, though, it demonstrates why networking behaviors in China – as well as in many other fast-growth markets – are much more diversified and sophisticated than is often assumed.