Social Gaming in Asia

Social gaming is already huge across Asia, as we saw in our recent reviews of Social, Digital and Mobile across Asia.

We’re anticipating further growth in the sector during 2012 too, with gamers in Southeast Asia, China, and Japan leading the way.

So, given their importance, it’s worth exploring the kinds of people who play social games in a bit more detail.

Strikingly, the Flowtown infographic below reports that the most prolific social gamers are women in their 50s – something that may come as a surprise to many marketers:

The profile of gamers in many parts of Asia mirror some of these trends, although the picture varies by country and platform.

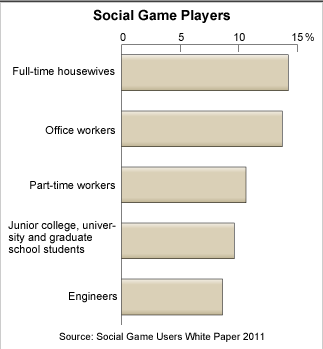

A recent report from Enterbrain suggests that housewives make up the largest group of Japanese social gamers:

The popularity of social games amongst housewives is also evident in the Philippines. On a recent trip to the country, we discovered that social games are popular with women across different socio-economic groups, with simpler games that can be played on basic mobile handsets being particularly popular.

Meanwhile, the infographic below, from gaming network GREE, suggests that the majority of its user base is male. However, the skew towards more mature players is evident here too; nearly half of all the platform’s gamers are aged over 30:

This trend towards older users is accelerating too – a report from Japan’s other large gaming platform, Mobage, indicates that its user base is also ‘greying’, in line with Japan’s overall demographic shift:

This broad interest means social gaming has become serious business in Asia.

Gree is already valued at more than US$ 7 billion, and has announced it expects to generate sales of up to US$ 1.8 billion in its current fiscal year.

Meanwhile, Mobage’s owners, DeNA, announced more than US$ 450 million in sales in the second quarter of its current fiscal year alone.

What’s more, the revenues generated by both these networks come largely from value-added services: 90% of DeNA’s revenues, and 80% of Gree’s revenues come from paid services, with advertising revenues contributing a far lower percentage.

Crucially, the majority of these value-added revenues come from players accessing games on mobile devices – an area we explored in our country report on Japan a few weeks back.

Japan isn’t the only country with a social gaming habit though – Southeast Asians are also prolific gamers. Effective Measure reports that there are more than 17 million gamers across the region, with Thailand and Vietnam leading the pack.

The report also found that gamers were not restricted to big cities, with a large proportion of players coming from the region’s rural areas.

China’s social gaming market is also significant; Sina Weibo alone reports that around 10% of its user base, or 25 million people, already play social games via its platform.

Given the significant growth of gaming in Southeast Asia, analysts predict that the sector will be worth more than US$ 1 billion within the next few years.

Meanwhile, the market for virtual goods is also worth serious money, with Asia-wide revenues already topping $US 7 billion in 2010.

In China alone, where annual revenues from virtual goods are believed to be worth around US$ 1.5 billion, authorities are even exploring ways to tax the industry.

This is unlikely to dampen Asia’s enthusiasm for social games though, and we fully expect to see more stellar user and revenue figures in 2012.

Credits: Serkan Toto for the Japan graphics; Econsultancy for the Flowton graphic.