Social, Digital and Mobile in China

Get ready for some huge numbers, as our latest #SDMW report takes a comprehensive look at all the latest online stats from China.

China has been the world’s largest online market for some time now, but its growth shows no sign of losing momentum.

We’ve explored a wider variety of data than usual in this #SDMW report to give a full flavour of online behaviour and trends across China, so alongside the usual Social, Internet and Mobile stats, you’ll also find some amazing data on e-Commerce, m-Commerce and Location-Based Services.

Here are the headlines:

- China has 564 million internet users, and the country’s online population continues to grow at a rate of more than 4 million new users every month;

- There are at least 597 million active Social Media users in China, with Tencent’s QZone continuing to lead, both in terms of registered and active users;

- More than 1.1 billion mobile subscriptions have been activated in China, and China’s citizens activate 4 new subscriptions every second, driving growth of 10 million new subscriptions every month;

- Mobile internet continues to dominate in China, with more than 400 million people across the country accessing internet services from their phones.

These staggering numbers give a sense of the scale of the online environment in China, but it’s only when we put the numbers in perspective that they start to have meaning.

China’s Population

A large part of China’s appeal to digital marketers lies in the sheer size of its population: if you took just 1 second to say hello to each of the country’s 1.34 billion people, it would take you more than 42 years to greet the whole nation.

The population is still growing too, albeit not as fast of some of its Asian neighbours.

China’s citizens are also slightly older than their Asian neighbours, with the media age of the population sitting in the mid 30s.

The Internet In China

China’s internet users outnumber the entire population of Western Europe, and continue to grow at a rate of 1.6 new users every second.

Much of the new growth is being driven by people from rural areas accessing online services for the first time via their mobile phones.

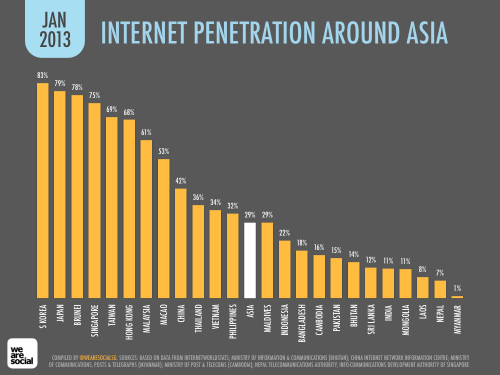

China now accounts for 51% of Asia’s internet users, and at 42%, online penetration in the country is well above the regional average of 29%:

Mobile is the primary internet access device for everyone in China, with 75% of the online population using their mobile phone for at least some of their internet activities.

China’s netizens spend an average of 3 hours per day online across all devices, with the most popular activities including:

- Instant Messaging (88%);

- Web Search (80%);

- Online Music (77%).

Online finance activities like internet banking and e-transactions lead the fastest-growing internet activities, and more than 220 million Chinese people now use these services in some form.

Social Media

Social Media continue to be the hottest internet story in China, with active users numbers fast approaching 600 million – almost twice the total population of the USA.

China’s social media users spend an average of 46 minutes every single day accessing social media sites; added together, this means social media users spent at least 167 billion hours – some 19 million years of human time – on social media activities in 2012.

The country’s social media landscape is dominated by platforms operated by homegrown internet company Tencent.

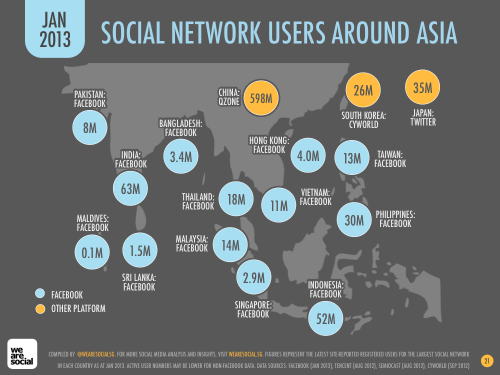

Counting users on its Qzone, Tencent Weibo and Pengyou site, Tencent claims to host around 56% of the country’s active social media accounts, and QZone is home to at least half of Asia’s total social media population:

Weibo have been a real Chinese Social Media success story in recent months, and with more than half a billion registered users on Tencent’s Weibo service, it’s perhaps little surprise that weibo have garnered so much media attention both with China and abroad.

Moreover, 89% of China’s netizens have used a weibo at some time or other.

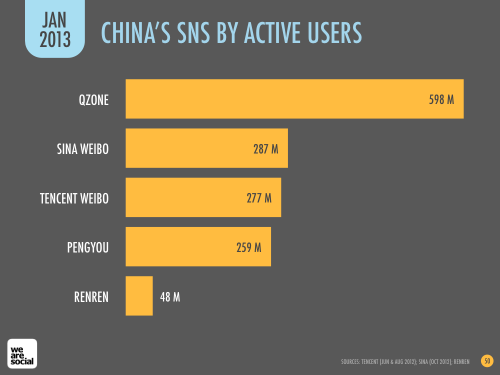

Active user numbers are a slightly different story though, with Sina’s Weibo service leads the weibo ctagory with almost 300 million active users:

The impressive growth of weibo were eclipsed in late 2012 though, with the explosion of one-to-one messaging services led by Tencent’s WeChat service.

With user numbers already in excess of 300 million, WeChat combines the convenience and intimacy of a messaging platform like WhatsApp and microblog-like ‘public posting’ features similar to those of weibo and Twitter.

WeChat is currently growing at a phenomenal rate, adding around 25 million users per month, the majority of whom are in China. Analysts are confident WeChat will add at least another 100 million new users in 2013.

More conventional instant messaging services continue to be ubiquitous in China too, with the country’s top platforms claiming more than 1.2 billion accounts. Tencent’s QQ service alone claims nearly 800 million users accounts.

In August 2012, 167 million of QQ’s accounts were online at the same time, setting a new record for the number of simultaneous users of the service. That’s more than the entire population of Russia.

Given all of this, the commercial opportunities offered by social media in China are clear, and extend well beyond the simple user numbers.

Two thirds of China’s social media users interact with brands in some way through social sites, and engage with an average of 8 brands each.

80% of the country’s social media users say they use these sites to search for information about products and brands, and almost 4 in 10 actively refer to their friends’ social media activities when making purchase decisions.

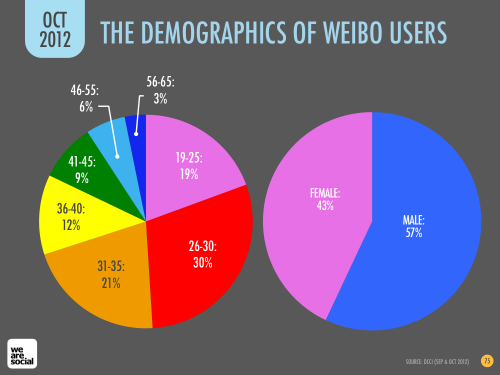

Social media use is also spread across age groups:

28% of weibo users actively search for brand information in weibo, and 50% of all weibo users claim to visit e-Commerce sites after noticing relevant information in weibo posts.

These numbers have inspired nearly a quarter of a million companies to set up a Sina Weibo account, and 25% of Fortune 500 companies – primarily companies based in the West – have a presence on China’s most active weibo platform.

72% of Sina Weibo’s users access the site via mobile devices, meaning the service’s contextual relevance has particular significance during active purchase occasions.

This contextual relevance extends to messaging apps too, and Tencent logs more than 700 million location-specific activities ever day via its QQ and WeChat services – that’s more than 8,000 every second.

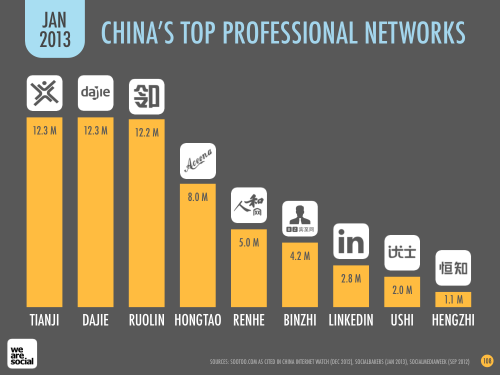

Professional Social Networking is also on the rise in China, with more than 70 million people now using dedicated platforms to build their business networks:

The largest professional social network, Tianji, is growing at a rate of around half a million users every month, while LinkedIn has enjoyed some success in China too.

Mobile

China’s mobile market continues to expand at an astounding rate, with 4 new subscriptions every second driving growth of more than 10 million new subscriptions every month.

Phones have become an integral part of Chinese citizens’ lives, with 70% claiming that they “can’t live without” their phone.

This may be due to the impressive functionality available on even relatively basic handsets in China:

It’s the mobile internet opportunities that we find most exciting though, and at 420 million users, penetration of mobile internet in China has already passed 30%.

China’s mobile internet browsers enjoy a variety of online activities from their handsets:

- News (62%);

- Web Search (46%);

- e-Books (44%);

- Weibo and Microblogs (41%)

The popularity of eBooks is of particular note; reading literature via mobile devices is hugely popular in China, and searches for eBooks topped the 2012 mobile search query rankings on China’s top search engine, Baidu.

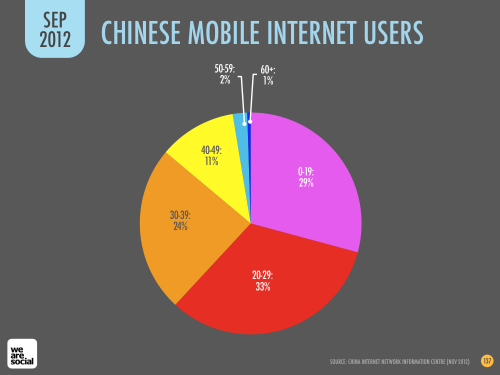

China’s mobile users are still skewed towards younger age groups though, and 62% of the country’s subscribers are under 30:

You’ll find plenty more invaluable stats in the full report – here are some more highlights:

- China’s e-Commerce market was worth more than 1 trillion RMB in 2012 (more than US$160 billion);

- Location-Based Services reach 217 million people in China;

- There are 350 million visitors to online video sites in China, who watch a combined total of more than 4 billion hours of online video every month.

If you’d like to know more about this report, please contact us by email, or call Simon Kemp on +65 9146 5356.

We’d also love to hear your thoughts, comments and questions via the comments section below.

Meanwhile, you can download a high-res PDF of the full report here.

Please note that you’ll find the relevant source for each of the individual stats in this post, and for each of the data points in the report, at the bottom right-hand corner of the relevant slide(s) in the full report.