comScore: 2013 UK digital future in focus

Last week, we reported on comScore’s ‘2013 U.S. Digital Future in Focus’ report. This week it’s the UK’s turn, so here’s everything you need to know about the British version of the report. You can find the full version here. If our summary of the report is too much for you, scroll to the bottom for comScore’s own ‘Tweetable Highlights’.

The current online and mobile landscape

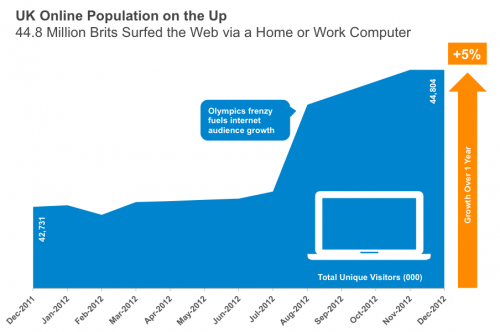

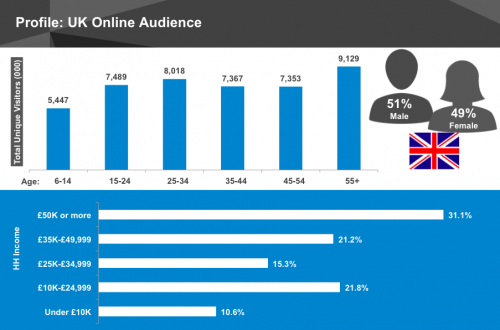

The report contains an interesting overview of the overall online and mobile landscapes. Most notably, it’s on the up by 5%, showing peak growth during the heavily talked-about Olympics. The male/female split is roughly even, while the average income tends towards the higher end of the scale.

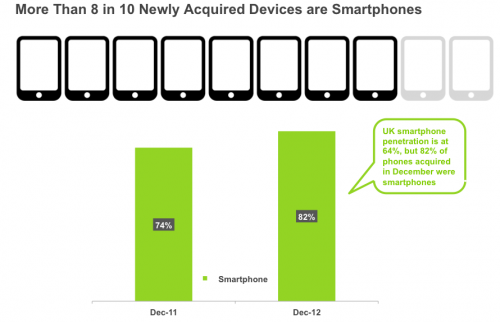

As for mobile, smart phone consumption is on the up; they now make up more than 80% of newly-acquired devices and hold market penetration of 64%.

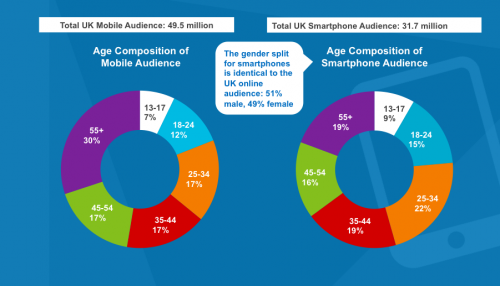

The below comparison of smart phone users with the general mobile audience displays that 25-34 year olds are most likely to own one of the devices, whilst the over 55s have a much larger share of the mobile demographic than its smartphone equivalent.

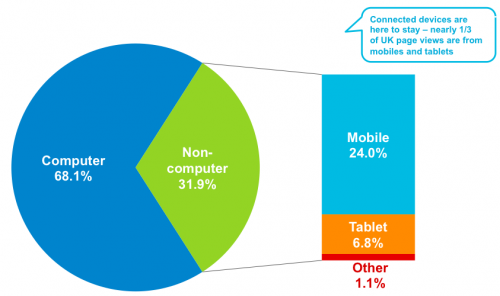

Mobile devices now account for a massive 24% of all page views. And tablets also account for a significant share of the online landscape, making up a growing 6.8% of all page views.

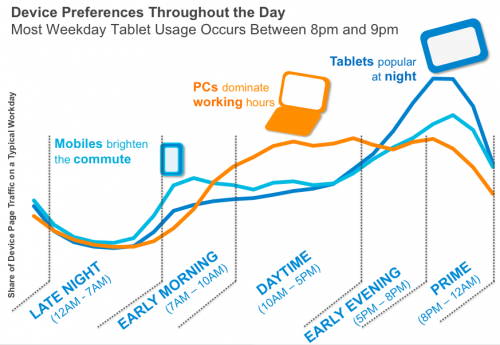

The popularity of different types of device varies throughout the day, too. The below graph indicates the times at which people most commonly use their various devices.

Social Media

There is one key message to be taken from comScore’s analysis of social and it comes when they decide to name check a certain social media agency:

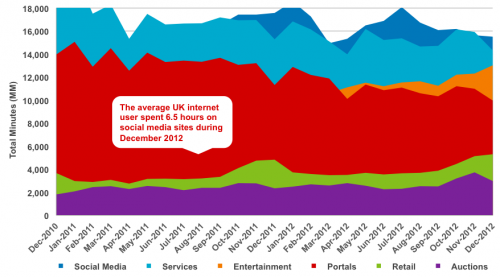

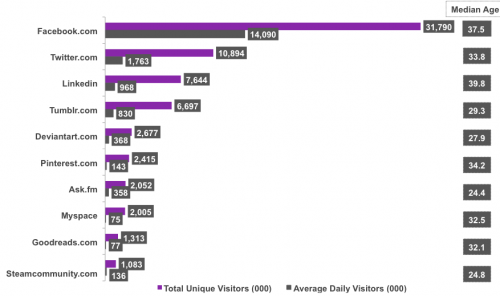

Really, that’s come straight from the report. There are a number of figures to back up the statement, too. First of all, social platforms have continued their strong share of the online audience throughout 2012 and capture the most PC screen time in the UK.

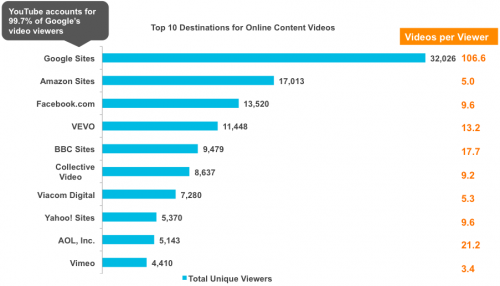

Unsurprisingly, most of that time is still spent on Facebook and Twitter, while Google sites (such as YouTube) maintain a huge share of the online video market.

The strength of online video has been supported by increased monetisation, especially amongst newspapers. 28.8% of total news videos include advertising, accounting for a total of 19,554 videos. As for specific newspapers, the biggest advertisers are The Guardian, who include ads with 30.7% of their video content, followed by Mail Online with 23.6%.

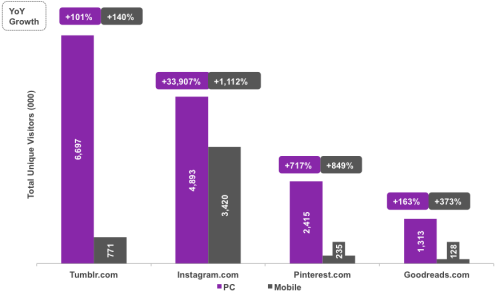

Despite the strong performance of the big social channels, newer platforms have shown phenomenal growth. Instagram’s UK mobile audience, for example, grew by 1,112% in the past 12 months.

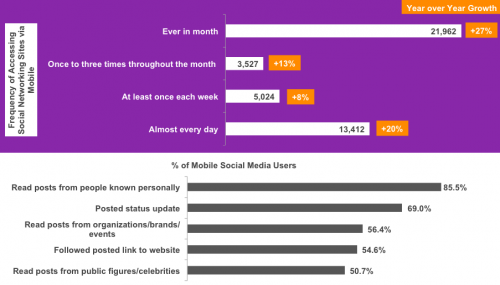

Indeed, mobile is becoming increasingly relevant in the social world, as indicated by the below growth in frequency.

The growth is mirrored specifically in terms of online video platforms; on PC, online video has seen 8% growth in comparison to a whopping 262% on mobile.

Digital advertising

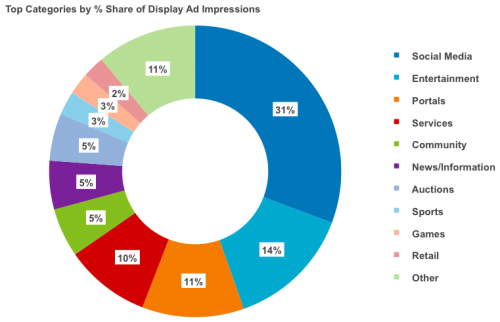

Throughout 2012, 923 billion display ad impressions were delivered, of which 31% were captured by social media sites. The next most significant advertising locations were websites involving entertainment, portals or services such as email.

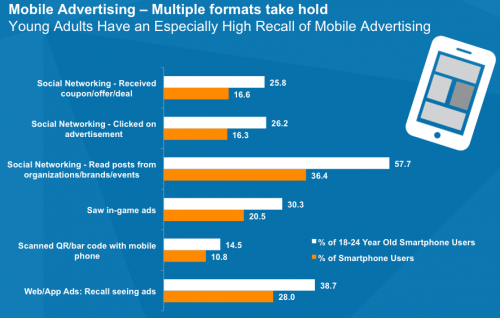

Mobile advertising has shown increasing variety as a medium; this has driven its success, particularly in the 18-24 year old bracket.

E-commerce and M-commerce

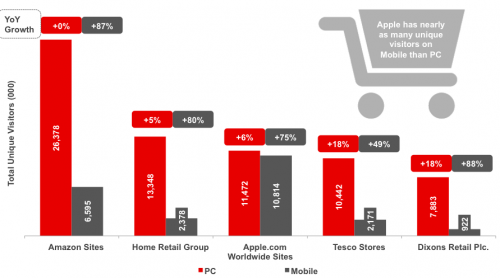

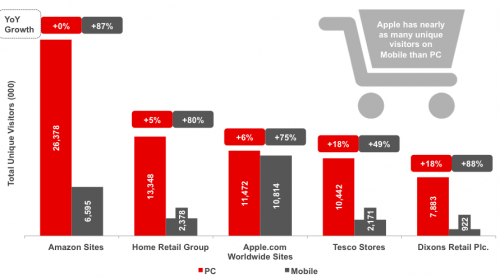

E-commerce has continued to grow in the UK in 2012, especially on mobile. An examination of the top 5 online retailers displays how this is the case:

Different retail subcategories have seen varying levels of growth online. The strongest five, in terms of page visits, are movies (up 100%), computer software (33%), consumer goods (32%), health care (28%) and food (17%). On the opposite end of the spectrum are apparel (up just 5%), consumer electrics (2%), books (1%). Two subcategories even took a hit: comparison shopping went down 6% and music down 11%.

Display ads have been hugely on the up amongst UK retailers, with eBay leading the way:

Three behaviours have defined m-commerce throughout the year: purchasing, showrooming and sharing.

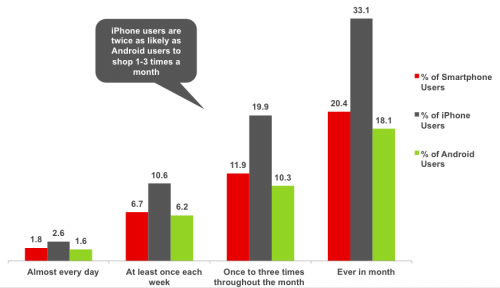

Finally, a word on specific devices. iPhone users are by far the most retail-friendly, while those using Android devices were less likely than the average smartphone user to use their mobile for shopping.

Summary

Finally, as promised, here’s the summary of the summary.