WhatsApp overtakes Facebook Messenger

GlobalWebIndex’s latest figures show that WhatsApp has now passed Facebook Messenger to become the top mobile chat app globally. But as Quack! Messenger launches in the UK – promising its users a share of ad revenue – what factors are driving the boom in mobile messaging? And what fate lies ahead for the humble SMS? Jason Mander, Head of Trends at GlobalWebIndex, exclusively talks us through some of their key findings.

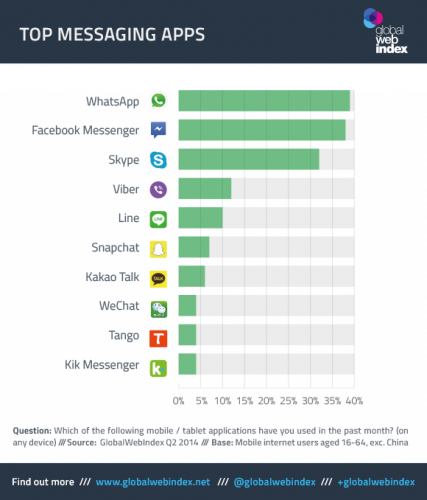

In 2014, we’ve seen an important transition in the mobile messaging space: WhatsApp is now being used by 39% of the mobile internet audience, pushing Facebook Messenger (38%) into second place.

Naturally, this global headline masks some notable local trends. WeChat is still the force majeure in China (being used by an impressive 84%), while Kakao Talk dominates in South Korea, Line is top dog in Taiwan and as many as 50% of teens in the UK and USA are wedded to Snapchat. Facebook’s Messenger tool has also received a significant boost from the network’s decision to remove the messaging functionality from its main app; in the UK, for example, the Messenger numbers jumped from 27% at the end of 2013 to 40% in Q2 2014.

Across the board, though, one pattern remains consistent here: messaging services continue to enjoy buoyant rises. It’s against this context that Quack! Messenger enters the arena, promising UK users a chance to earn money in return for watching “wanted” advertising during conversation breaks (as it has already been doing in Spain and Italy under the name Chad2Win).

As the messaging space gets more crowded, it’s important to recognise that SMS/text messaging hasn’t been abandoned; overall, more people are still communicating via text than they are via IM services. However, the volume of messages being sent as via “traditional” SMS or MMS routes certainly is changing – with both formats now trending gently downwards after years of consistent growth.

To understand the reasons behind this, GlobalWebIndex surveyed 500 WhatsApp users in the UK. The results suggest that the once-dominant SMS has some pretty tough times ahead: just under two thirds of WhatsAppers say that chat apps are now one of their primary forms of communication, with over half saying that they almost always use them in preference to sending messages via SMS. The prospects for MMS are even more troubled: only 16% think that sending photos and videos via MMS is better than via a chat app.

Convenience and reach stand out as key drivers for this trend; two thirds say that mobile messaging services are the easiest way to send photos and videos, with a similar proportion claiming that they use them because most of their friends/family do too. Cost is also a big factor here: people like the idea that they are saving money, especially when sending messages internationally.

If we then turn our attention to attitudes among current SMS fans – that is, people who are currently using mobile messaging tools but who still prefer sending text messages – the future prospects for the messaging services look particularly bright. Those who still favour SMS are influenced the most by the ability to send messages without an internet connection (68%), the availability of unlimited SMS messages from their operator (68%) and the fact that not all of their friends are using mobile messaging apps.

But we have to imagine that all of these factors will be key targets for the mobile IM platforms: coverage will get progressively better, the offer of unlimited texts will get less relevant/impactful and the numbers of people using IM tools will increase. Perhaps most significantly of all, just 10% of people say they don’t trust mobile chat app companies with their conversations – which would arguably have been by far the biggest barrier against IM tools taking further ground from SMS.

So, as we approach the middle of the 10s decade, it seems inevitable that – while we won’t be saying a final RIP to the SMS or MMS – we’ll be hearing much less about them as a greater share of communication takes place via chat apps. In that context, WhatsApp’s price-tag becomes a bit easier to understand.

Note: GlobalWebIndex conducts quarterly research across 32 markets, representing nearly 90% of the global internet audience. Penetration figures for individual messaging services are a global average excluding China. Download a free summary of GWI’s new Mobile Messaging trend here.